An Analysis of Complaints and Claims.

As we all know, the most important aspect of any business is the customer – without customers, a business cannot succeed. It is happy, satisfied customers who carry the business to great success.

However, even the best businesses will sometimes have unhappy customers. As poet and priest John Lydgate once observed:

“You can please some of the people all of the time, you can please all of the people some of the time, but you can’t please all of the people all of the time”

Obviously, in business what we really and practically want is to please as many people for as much of the time as possible, so to understand why customers become unhappy helps to manage future customer expectations and achieve that ambition.

This article considers some complaints and claims looks at the reasons why people complain and explores how complaints can lead to a claim.

The difference between a complaint and a claim

Before we look at the issues in detail we should initially remind ourselves what a complaint is and how it becomes a claim against an insurance policy:

A complaint is ‘a statement that something is wrong or not satisfactory’ and a claim is ‘a successful application for compensation under the terms of an insurance policy’.

How and why do people complain and why is it important

There are multiple ways in which a complaint can be instigated – via post, email, telephone or (very rarely) in person.

So why does a person complain?

- They may be unhappy about something out of the surveyors control

- They may be unclear about the level of service they have commissioned, the role and responsibilities of the surveyor and about the restrictions on the surveyor when carrying out the inspection

- They might simply just be unreasonable – casting round for someone to blame when things might not have gone quite to plan

- Because they have regretted the purchase for any number of reasons that may not include any shortcomings on the part of the surveyor

- Because something has genuinely gone wrong and the surveyor is the ‘low hanging fruit’

- Because a tradesperson has gone round to quote for something and suggested ‘the surveyor should not have missed that’

- There may be a genuine shortcoming on the part of the surveyor

And why does this matter – even if the complaints never lead to a claim?

- Because receiving a complaint can be very stressful for the surveyor

- Because a complaint can be very time consuming to manage

- Because, even if the surveyor is completely exonerated, a complaint can leave a mark on the reputation of the business

The complaints picture

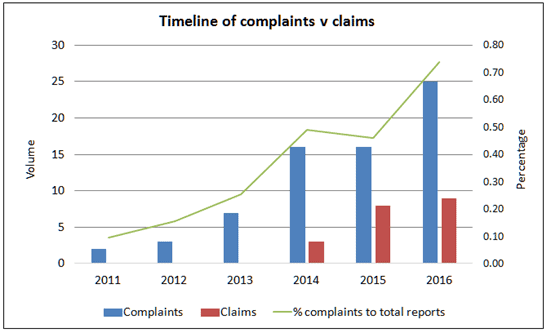

Looking at a sample of surveys carried out over the last 6 years the first thing to note is that from 2014 till today there has been an increased number of complaints and an increased number of claims. 2016 The number of complaints received in shows the highest percentage of complaints received.

Figure 1 – Timeline of complaints vs claims

Now, this could mean that surveyors who form this sample group are getting worse at their jobs, but this is most unlikely. Instead, what it demonstrates to us, borne out by conversations with brokers and insurers, is that we seem to be living in more litigious times.

We also are not wholly confident that the above graph is a complete and true reflection of the complaints picture. We suspect many more surveyors will have received a complaint and that many are dealt with successfully in the first instance and not then formally recorded as a complaint.

Advice from SAVA:

If a situation arises resulting in the return of the survey fee this is classed as a complaint and, tempting though this is, returning the client’s fee is not something we recommend. Talking with our insurers this does not guarantee the problem will go away but can be taken as an admission of liability on behalf of the surveyor which can go against the surveyor if the complainant decides to take the matter further.

So what are the issues which lead a client to raise a complaint?

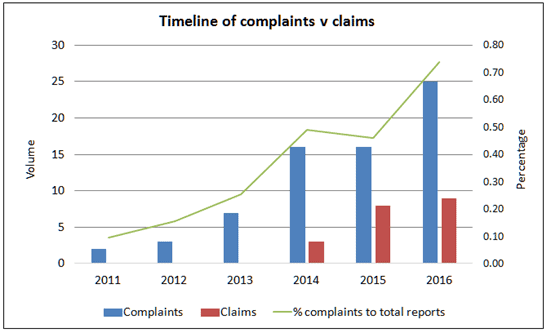

Figure 2 shows that the 3 major reasons for submitting a complaint are:

- Damp issues,

- Structural movement

- Issues with Services

Figure 2 – Subject of HCS complaints

The next significant reasons for a complaint we have grouped under the heading “Code of Conduct”. These make up 9% of all complaints. Some examples of “Code of Conduct” complaints are:

- Security of the property – Surveyor left the property rear door and/or windows open,

- Issues with quality of the survey report – inadequate descriptions, photos, or using professional jargon which clients struggle to understand,

- Damage caused to the property at the time of the inspection – cracked ceilings, overflowing sinks, etc.

- Data protection issues – sharing details of the property with an unrelated party

Woodworm (which of course could also be classed under Damp) is another defined reason for a customer complaint, triggered by limited or no comment made in report on the presence or absence of woodworm.

Invasive plants at or adjacent to the subject property is another quite significant trigger for client’s dissatisfaction.

Under the heading “Health and Safety Issues” we have included complaints regarding the lack of identification of asbestos containing materials, lead paint and lead pipework within the surveyed property. We have also received a complaint about the lack of clear advice about such health and safety matters.

Complaints usually come from clients for whom the survey report is prepared. However, in a few instances, and in particular where there has been damage to the property during the inspection process, the complaint has been generated by the seller of the property. Also, 3% of complaints have been generated by disgruntled sellers, reasoning that the survey report has revealed issues which made the potential buyers pull out of the property transaction.

Analysis of damp issues

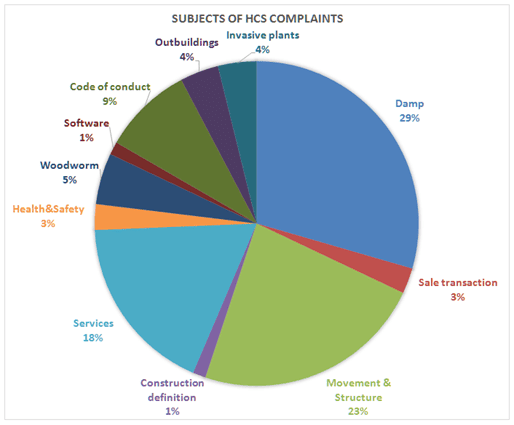

Figure 3 – Damp related complaints

People get very worked up about damp and damp issues are the most common reason for a complaint to be generated.

Analysing those complaints further, we can see that half of the issues are directly related to penetrating damp (moisture penetrating from outside through a building element) and the majority relate to roofs.

Interestingly, and despite all of our concerns relating to flat roofs, actually 80% of the complaints specifically relating to roofs have been regarding pitched roofs, and only 20% of roof complaints have been about flat roofs. This could be testament to the quality of surveyor training over recent years from Bluebox Partners and similar – warning surveyors of the risks associated with flat roofs so they take more care on the inspection and report.

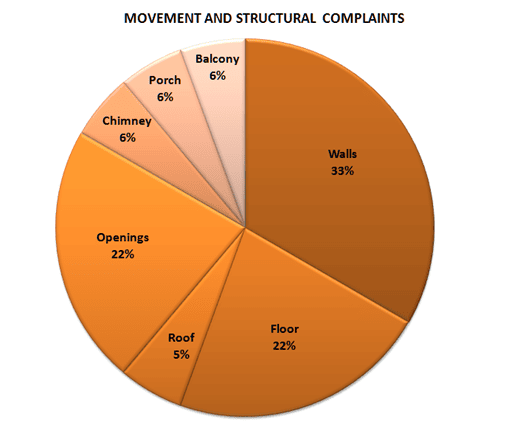

Analysis of movement and structural issues

Figure 4 – Movement and Structural complaints

In the vast majority of homes, walls have the largest area, so it is no surprise to see that for Structural movement complaints, problems with walls make up the majority of the complaints.

Examples of such complaints relate to structural stability of gable end walls, bowing and distortion of external walls, applying render to timber frame walls and its implications, structural movement of the subsoil, etc. Often if there is structural movement to walls this also affects floors and openings, and within some complaints multiple issues are linked together.

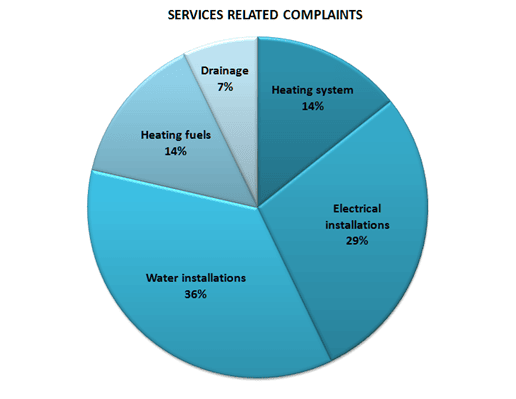

Analysis of service issues

Figure 5 – Service related complaints

When looking at complaints relating to the services the majority relate to the water installations. We have seen complaints relating to the location and operation of stop cocks, leaks to showers and various plumbing issues. Under the Electrical Installations complaints arise where surveyors have assigned the wrong condition rating; for example for an electrical installation Condition Rating 1, but there was no evidence of a recent certificate being available and a Condition Rating 3 should have been applied by default.

The Heating Fuels section relate to complaints about the location and condition of oil tanks and gas meters.

Complaints – best practice

If you ever receive a complaint you should follow a protocol to ensure that complaints are all handled in the same way. Also, you should check the terms of your insurance policy. There are many policies that require the insured to notify the insurer of “any complaint that might become a claim under the policy.” Failure to do so can lead to the insurer actually refusing to accept the claim due to a breach of a condition of the policy. It is extremely important that you check the wording of your insurance policy. When considering a complaint you should first of all look at the ‘root cause’ of the issue. If the root cause of the complaint proves to be uncontentious and straightforward the complaint turns into a claim – these situations include Public Liability issues (damages to property by surveyors).

However, our research indicates that in majority cases complaints relate to Professional Indemnity where the professionalism of the surveyor is being challenged, and here the investigation should focus on the inspection methodology and whether the issue was reported on, and can be evidenced satisfactorily to substantiate the matter.

SAVA handles claims and complaints on behalf of our members and when we do we work very closely with our insurers on this, and if we take the view that a complaint could not be defended were it to go to court, perhaps due to lack of clear photographs, inadequate site notes etc. then we will take a pragmatic and commercial approach, negotiating with the claimant to reach a mutually acceptable settlement.

It is very important to note that the following applies:-

- Our starting position is always to defend a claim and to ‘bat it away’

- We take the same approach to a claim irrespective of the size

- By the time a complaint becomes a claim we will have already have entered into a significant volume of correspondence with the claimant

- When a complainant does take legal advice this will almost always result in the insurers instructing specialist solicitors. When they do we work closely with them as well as the claims handlers

- We always review the evidence (site notes, photographs, report etc.) and write an initial report for the insurance claims handlers. If we feel that the surveyor’s site notes and photographs are poor, we will report this and this will affect the approach the insurers take. If we think the site notes and other evidence is very strong the insurers will be much more robust in their approach to the defence. This is a commercial reality

- We, that is SAVA, the insurers and any solicitors if appointed, want to avoid going to court. Some surveyors have challenged our approach if we start to negotiate, but the reality, particularly in the light of point 2 above, is that the courts do not look favourably on a party where they think an out of court settlement could be reached

- When we do reach a settlement we do so without admitting any liability on the part of the surveyor (whether or not any liability existed)The claims handlers at the insurance company have a legal background and their experience in the workings of the courts in invaluable when considering this

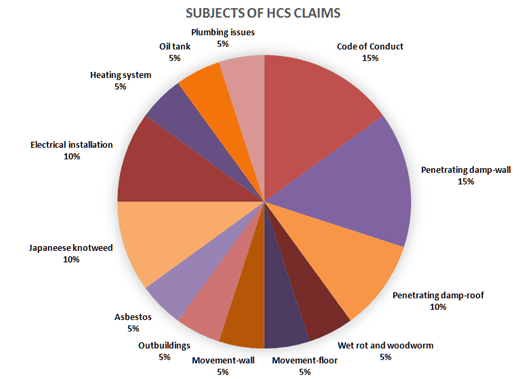

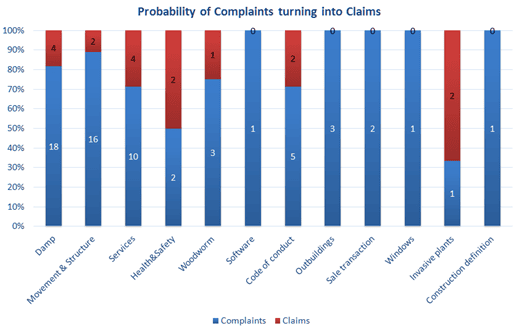

Of course, not all complaints end up as a claim. The following graph shows for which categories a complaint turned into a claim.

Figure 6 – Subject of HCS claims

Figure 7 – Probability of complaints turning into claims

Despite the fact that complaints predominantly relate to damp issues, less than 20% of these complaints turn into a successful claim. However, complaints related to Invasive plants (Japanese Knotweed in particular) have nearly 70% chance to be justified as claims and Insurance will pay out. Similarly, with limited identification and/or reporting on Health and Safety issues, complaints related to unidentified or unnoticed asbestos or lead pipes are likely to turn into claims. This is logical, if you think about it. The issue is not that the Japanese knotweed is present, but if the surveyor should have seen or reported on it.

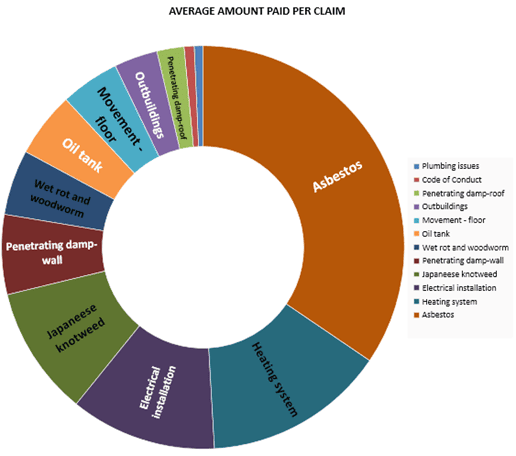

In terms of amounts paid to settle claims the largest average pay out against the insurance policy to date relate to Asbestos followed by, Services, Invasive plants and Damp related issues.

Figure 8 – Average amount paid per claim

When do people complain?

Analysing our data, we have observed that there are certain times during the year when higher levels of complaints are registered. The busiest months are September, October, November and December, which suggests that the property is likely to manifest its weak points during the winter season, prompting Clients to raise complaints.

Conclusion

From the statistics we currently have it is difficult to draw any definitive conclusion, particularly in relation to the size of claims. That said, we can still draw some conclusions from our experiences to date.

- The percentage of complaints is increasing

- More complainants are going straight to law without trying to resolve the issue first (still admittedly tiny numbers, but nevertheless significant and will affect the way we approach the complaint)

- Claims and complaints take a lot of time to manage and we appreciate that they can be very stressful for you, the surveyor

- The quality of the site notes, photographs and other evidence collected on site is crucial to the success of the complaint and, if a settlement is reached, to the size of the pay-out.