Client Management and Technology.

You can be an excellent surveyor, but that in itself does not necessarily mean you will never receive a complaint or claim. Having a strong client management process in place will not only provide a consistent customer experience for your clients, but it could potentially avert a claim or defend you in the event of one.

In this article, Matt Nally talks through the processes of a job from start to finish and highlights how technology can help to streamline them.

Dealing with multiple customers and properties each week makes it hard to remember the finer details from your conversations, emails, and calls. The more work you take on, the more you must remember. And even if you only handle low volumes of work, we all have external pressures from our personal lives; this all takes up memory space.

Complaints and claims aren’t always immediate, and they can arise some years after a survey or valuation was undertaken. We’re all notoriously bad at remembering things accurately as time goes on, and so having consistent clear job records from start to finish is key for both giving the right advice at the time of a survey, as well as being able to back yourself up in the event of a claim several years later.

When does your job start?

Your job starts the first time you speak to someone as a potential customer, and it finishes with your last touchpoint with them. Why? This is the first time you’ll provide information or advice to a customer based on the details they have provided. There is a subtle difference here (these are our opinions and not legal advice):

Information: This is where you highlight what is included in different reports and the types of properties it suits.

Advice: This is where you recommend that a particular survey is more appropriate to the customer’s needs and influences their decision on which service to instruct.

It is important to note all of these conversations down so you can show the advice given to your customer was correct based on the details provided to you. Of course, if it later turns out that a different survey is needed, your advice to the customer on this should also be recorded.

You may provide a quote to a potential client which will have allowed for the factors requested. Your agreed terms should also outline them. The RICS Home Survey Standard provides clear guidance on what you need to list in your terms. Making sure you are compliant with these requirements is an important step in the process of documenting any special agreements and confirming the exact scope of your report.

A clear job record with notes of all conversations (especially conversations where a client has specifically pointed out an area of their concern), supported by clear and compliant terms, will help you to cross-check and ensure everything is covered before you send your report. It will also show third parties (such as insurers, expert witnesses etc.) that you have diligent and consistent processes in place, which suggests the evidence you have provided is reliable. Remember, every touchpoint where you provide advice could also be a potential liability. This doesn’t mean you shouldn’t provide advice, but it’s important to record exactly what you said and when. With the right processes in place, tracking all of this information is just as easy to remember in 5 minutes as it is in five years.

What information should you have records of?

There are a number of different touchpoints and types of data that you’ll collect throughout a survey. These include items such as:

- Emails

- Calls

- Signed terms

- Invoice / payment

- Site notes, photographs, and desktop research

- Client notes of every conversation

- Advice on the survey required

- Final report

- Post report advice

Joining the dots with the right processes

There are numerous ways in which you can record and store this information to aid with both customer service and managing claims. How you store this information can make a big difference to your business, and which process is best depends on a number of factors:

- Confidentiality – ensuring that only the correct, authorised user can view, access, change, or otherwise use data.

- Integrity – ensuring that the system and information is accurate and correct.

- Availability – ensuring that systems, information, and services are available the vast majority of the time, and when you need it as well as how quickly you can collate all of the information for a job. Disconnected processes can be more difficult to implement consistently and make it harder for analysis and retrieval of information. This also includes your ability to easily comply with GDPR and answer customer queries about exactly what data you hold about them.

- Retention period – how long you are storing this data. You cannot store data indefinitely and you need to consider the cost of storing data for the duration of your retention period. The limitation period on most legal claims is six years and some claims can be brought up to fifteen years later, so you need to set a sensible retention policy for records should you need to defend a claim.

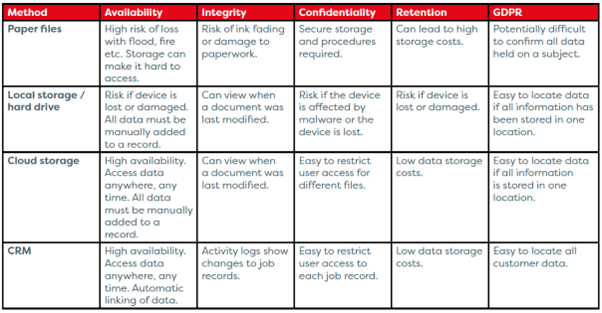

Some options available to you are listed below. Let’s compare some of the pros and cons of these against the factors above (some may be obvious, others might not):

Each storage method has its pros and cons. Paper records are traditional but costly and it can be difficult to find all related records quickly if not correctly stored. Records could crossover for different customers or properties and, if not correctly referenced it would be easy to miss information when you need it.

Hard drives, whilst easier to search for data, have their own risks. Someone recently lost a hard drive containing £200m in cryptocurrency (story here) and they’ve still not been able to locate it. Losing customer data and your supporting records isn’t something you’ll want to do. If you use this method, backups of each hard drive should be kept, and data should be encrypted to keep it secure. However, you need to ensure you don’t forget your encryption key so you don’t lose access!

Cloud storage and CRM systems provide the quickest and easiest way to access data, but cloud storage doesn’t offer the automation and record linking capabilities that a CRM can, meaning that whilst it is accessible, it may not easily offer you the whole picture of a customer or property with ease.

Client/Customer Relationship Management (CRM) – the modern tool for client management

The optimal solution in today’s world is a Customer Relationship Management (CRM) system that provides a centralised location for all of your customer records. The difference between cloud storage and a CRM is that a CRM can automate a number of administrative tasks to help ensure your job records are consistently created and the information retained. The CRM system can handle this for you so you can focus your time on customers and ensure your reports are compliant with requirements.

A CRM system will enable you to search for a job, customer or property record and see everything you need immediately including other jobs linked to the customer or property. This helps you to answer customer queries more efficiently and with confidence, whether you are booking a job, you are out on site, needing to double-check your customer requests during your report write up, or 5 years after your report was submitted. Your data is confidential with access easily provided to or revoked from other users (if any).

Survey Booker is a specialist CRM and survey management system for the surveying industry. It can feed all your leads from multiple sources into one dashboard, so you instantly have a record to work from. You can manage terms by automatically prefilling important data to save time, handle payments and invoicing, and provide updates throughout a job. All correspondence can be automatically stored, and you can add notes from every conversation to each record. If you need to find information about a job, it can be accessed in a few clicks.

The benefits of a CRM go beyond managing claims. By handling your processes more efficiently and consistently, a CRM can help you grow sales, save time by automating manual admin processes and ensure compliance with industry requirements. Automation of manual processes can also help to prevent data errors and ensure data integrity. During a claim, this could help evidence that you take the accurate management of your customers’ requirements seriously.

Conclusion

Processes are key for ensuring that you can manage your clients effectively each and every time and are an important tool in providing a great customer experience. Technology can support you with implementing your processes whilst also helping you to save time, grow sales and support you in keeping your records confidential and safe.

A CRM is a modern solution used in many industries and suits companies of any size due to its ability to automate admin tasks and remove human error. Whilst many people may associate them with large firms who need to be able to manage huge volumes of data, they are just as important for small firms and individuals. By implementing a CRM like Survey Booker you can ensure you run your business with consistent processes, consistent client management and access to everything you need whenever, or wherever you need it.

About Survey Booker

Survey Booker is a Customer Relationship Management (CRM) and survey management system. Designed for the surveying industry, Survey Booker helps you to save time by automating manual admin tasks, grow sales by supporting your customers and nurturing new leads, improve compliance through clear job records, integrated terms and more and understand your business through reporting dashboards. Our unique software integrates with your website as well as with industry systems such as comparison sites and report writing software so you can focus on providing great surveys instead of admin.

Contact Survey Booker to find out more about how you can streamline your processes, boost your customer experience and ensure compliance with industry requirements.

https://surveybooker.co.uk