Climate Change – How it Affects Our Homes.

After a year of extreme weather events and in the month that the RICS launched its revised consumer guide on flooding warning that extreme flooding could become more common in the UK due to the effects of climate change, we look at climate change and how it might impact on our homes.

Introduction

It is now accepted that climate change poses a significant global threat. Governments, their agencies and big and small corporations have announced climate emergencies and made commitments towards Net Zero emissions across a range of target dates.

Regulators, including the Bank of England, have tasked the financial institutions under their authority in both the insurance and banking sectors to stress test their existing portfolios and ongoing lending practices against existing and emerging climate-associated risks such as flooding, coastal erosion, storm, and subsidence, and to produce forward facing forecasts across the perils and the natural physical and societal risks.

If the primary function of our houses is to provide shelter, then surveyors have a role to play when advising their clients on the resilience, or otherwise, to climate change of the property they are inspecting. From rainwater goods to overheating, it is important to understand how more extreme and frequent weather patterns could shape how we live in our homes and what can be done to mitigate the associated risks.

In this article, we consider how climate change could impact homes in general.

Climate change in a nutshell

Whilst science tells us that the temperature of the planet has fluctuated throughout history, since the 1850s, average global temperatures have risen by more than 1°C and it is now accepted that human activity, particularly since the industrial revolution, has contributed to this rise in temperature over the last 170 years.

The United Nations defines climate change as:

“Climate change refers to long-term shifts in temperatures and weather patterns. These shifts may be natural, such as through variations in the solar cycle. But since the 1800s, human activities have been the main driver of climate change, primarily due to burning fossil fuels like coal, oil and gas.

Burning fossil fuels generates greenhouse gas emissions that act like a blanket wrapped around the Earth, trapping the sun’s heat and raising temperatures.”

The 2016 Paris Agreement came into force in November 2016. This is a legally binding international treaty on climate change and was adopted by 196 parties at the twenty-first session of the Conference of the Parties (COP). The intention of the agreement is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

From this, the UK made a target to reach ‘net zero’ by 2050, meaning any greenhouse gas emissions produced will be less than or equal to the amount taken away. There are various papers and policies that have been published, and the Committee on Climate Change (CCC), an independent, statutory body established under the Climate Change Act 2008, have been a key driver in pushing for legislation and action to be taken in the UK. (There is more about the Committee on Climate Change here https://www.theccc.org.uk/)

For the UK, the key environmental perils being reported are:

- Flooding (surface, and coastal)

- Coastal Erosion

- Ground Subsidence

- Windstorm

Property professionals are ideally placed to use their core skill set to recognise the risks and advise on how to improve a property to lower its contribution to climate change and achieve net zero.

Subsidence

According to the Met Office, 2022 was the 6th driest summer on record (103mm) for England, and the driest since 1995 (66mm), with southern England experiencing the driest summer on record. For the UK overall, it was the 10th driest summer (156mm) and the driest since 1995 (106mm).

With dry weather comes the risk of subsidence, and according to the ‘This Is Money’ website, the total number of subsidence insurance claims for 2022 is likely to surpass 2018’s record (when 23,000 claims were made amounting to a bill of £145m). The insurer LV has already reported a 205 per cent jump in claims between June and July, and ‘This Is Money’ website indicates that other firms are reporting cases rising five-fold.

Subsidence can impact on the value of a property, and some lenders will often refuse to offer a mortgage until any subsidence has been resolved. While there are home insurance policies that will cover for subsidence, firms will ask new customers if there has been a problem in the past. If there have been issues, some insurers will refuse cover and premiums can be more expensive.

The RICS has produced a consumer guide on subsidence, and it can be found here: https://www.ricsfirms.com/media/1196/rics-consumer-guide-subsidence.pdf

Of course, not all subsidence is the result of seasonal changes in shrinkable clays, and it is imperative that surveyors understand the underlying soil conditions, the range of potential problems that may occur and how they may impact the subject property.

As part of the Sava Diplomas (both the ‘Residential Surveying’ and ‘Residential Surveying and Valuation’ qualifications), there is detailed content on where residential properties are built and the issues around site investigations (including environmental considerations, online research, watercourses and flooding), environmental considerations, testing, and hazards. The subject is too broad to go into detail in this article.

Overheating

When talking about net-zero there has been a considerable focus on insulating homes, making them more airtight to reduce heat loss and therefore using less energy to generate heat. If we have the heating on in the winter and feel hot, we can turn it down. However, when the temperatures are high and during heatwaves, homes can receive too much ‘solar gain’ and can overheat.

Following the 2022 heatwave (when some locations recorded temperatures in excess of 40 degrees Celsius for the first time ever) initial analysis by the UK Health Security Agency (UKHSA) indicated that there were an estimated total 2,803 excess deaths in England in the age group 65 and over (this excluded coronavirus). This is the highest excess mortality figure during heat-periods observed since the introduction of the Heatwave plan for England in 2004 and from 17 to 20 July, when temperatures were at their highest, there were an estimated 1,012 excess deaths in those aged over 65.

These figures demonstrate the possible impact that hot weather can have on the vulnerable, often the elderly, and how quickly such temperatures can lead to adverse health effects in at-risk groups.

Of course, not all subsidence is the result of seasonal changes in shrinkable clays and it is imperative that surveyors understand the underlying soil conditions, the range of potential problems that may occur and how they may impact the subject property.

As part of the Sava Diplomas (both the ‘Residential Surveying’ and ‘Residential Surveying and Valuation’ qualifications), there is detailed content on where residential properties are built and the issues around site investigations (including environmental considerations, online research, watercourses and flooding), environmental considerations, testing, and hazards. The subject is too broad to go into detail in this article.

There is a formal definition of overheating. The Chartered Institution of Building Services Engineers (CIBSE) define overheating as: ‘conditions when the comfortable internal temperature threshold of 28°C is surpassed for over 1% of the

time.’ CIBSE also defines 35°C as the internal temperature above which there is a significant danger of heat stress.

A study led by Loughborough University, in partnership with the BRE, found that 4.6 million English bedrooms (19% of the stock) and 3.6 million living rooms (15%) were subject to overheating (these results were weighted to the national housing stock).

The other key findings from the study were:

- Overheating was more prevalent in bedrooms at night than in living rooms during the day.

- The prevalence of living room overheating was significantly greater in flats (30%) than other dwelling types.

- Improved fabric energy efficiency did not significantly increase the risk of overheating.

- The prevalence of monitored overheating was greater in households living in social housing, with low incomes or with members aged over state pension age.

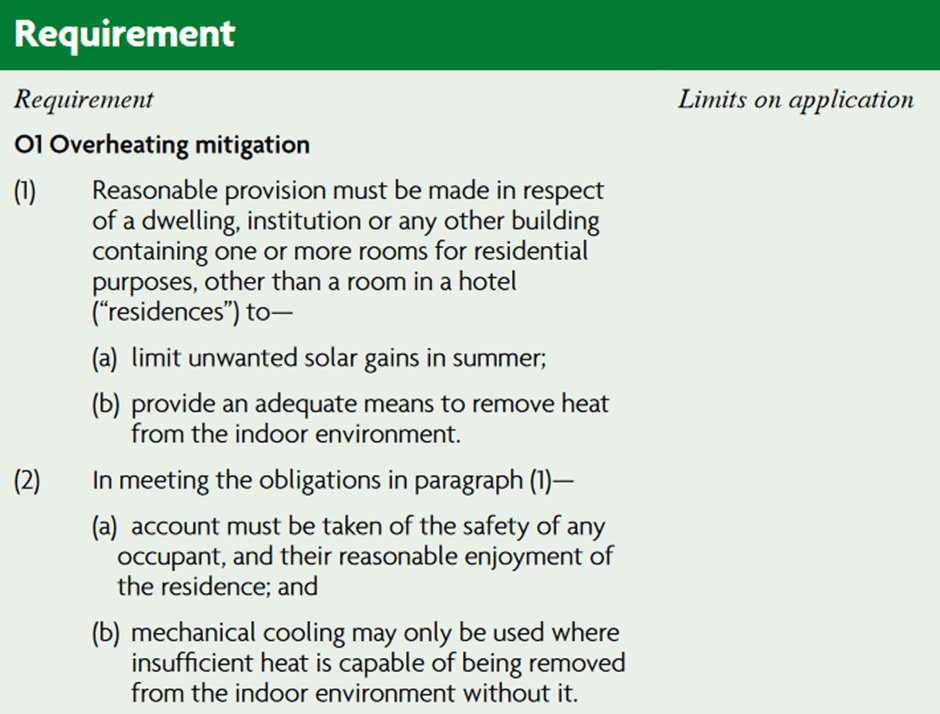

The document details a ‘simplified method’ for demonstrating compliance with the above requirement whereby the strategy to reduce overheating risk should be selected according to the location of the new residential building and whether it has cross-ventilation.

The alternative method involves dynamic thermal modelling for demonstrating compliance.

The document lists strategies for limiting solar gains, including fixing shading devices such as shutters, external blinds, overhangs, and awnings.

It also states excess heat should be removed by any of the following means:

- Opening windows

- Ventilation louvres (A set of angled slats that allow air or light

- to pass through) in external walls

- A mechanical ventilation system

- A mechanical cooling system

Approved Document O – Overheating only came into effect in June 2022. The new regulations are likely to have an impact on the design of future homes, particularly in ‘high-risk’ areas like London. Requirement O1 states:

There is a useful article here on overheating in buildings and design strategies that might help.

In 2016 the BRE published an assessment protocol for Overheating in Dwellings. The protocol sets out how to inspect a property, which will be more than familiar to surveyors, but it also includes recording the occupiers (since different occupiers will have different susceptibility to overheating). It also discusses how to identify the characteristics and deficiencies likely to increase excessively high indoor temperatures, and also those that may mitigate against high temperatures or provide protection.

Matters increasing the likelihood of overheating:

- Located in an urban heat island – resulting in relatively high external night-time temperatures.

- Located on the top floor of an apartment block – increasing heat gain.

- Located at ground level or adjacent to an access balcony in an apartment block – possible lack of security deterring opening of windows.

- Located adjacent to a busy road, railway lines, industrial plants, or airport – sources of noise deterring the opening of windows.

- Windows to rooms facing South through to West – increasing solar heat gain.

- Little thermal insulation – increasing heat gain.

- Highly insulated and relatively air-tight (i.e. tightly fitting doors or windows) – retention of internally generated heat and solar heat gain.

- High thermal mass – retention of heat to be given off at night.

- Single aspect apartment facing South through to West – high solar heat gain and no means of through-ventilation.

- Little or no insulation of internal heat sources – e.g. un-insulated hot water tanks and pipes.

It also notes those matters that provide protection from overheating:

- External greenery in urban areas – that can reduce reflected heat.

- Windows to rooms facing North through to East – providing ‘cool’ rooms.

- External shutters, blinds or awnings to windows facing South through to West which can prevent solar heat gain.

- Internal shutters, blinds or heavy curtains – providing a small reduction in solar heat gain.

- Thermal insulation to roof – reducing heat gain.

- Windows to rooms to first floor or above – allowing night-time purge ventilation.

- Air conditioning – reducing internal ambient temperatures.

The above are not issues that surveyors would currently consider within their remit, but if we see a rise in the incidence of extreme heat events this may be something surveyors should consider including, particularly if they are aware of the vulnerability of clients.

There is more about the BRE assessment protocol here https://www.designingbuildings.co.uk/wiki/Overheating_-_assessment_protocol

Extreme wind and rain

Wind

Although they have been surpassed by other extreme weather events in 2022, we should remember that in February 2022, three named storms affected the UK within the space of a week. It was the first time that this had occurred since storm naming was first introduced in 2015/2016.

The Met Office issued two rare red warnings for storm Eunice, the most severe and damaging storm to affect England and Wales since February 2014. Eunice battered exposed coastal locations with winds gusting at over 81mph, with one gust of 122mph recorded at Needles Old Battery on the Isle of Wight. This was a new England gust speed record.

These storms were part of a turbulent spell of wet and windy weather for the UK that was associated with a powerful jet stream. Storms Dudley and Franklin also brought winds gusting widely at over 69mph across southern England.

These storms created mayhem. The Met office reports that four people died in the UK and Ireland as a result of falling trees, and in excess of 1 million homes were left without power due to damaged powerlines. The ongoing power cuts lasted several days, also affecting schools and businesses, and there was major transport disruption, with trains cancelled and roads blocked by fallen trees and overturned lorries. It has been estimated that Eunice caused in excess of £360 million worth of damage in the UK.

There is more about the impact of Eunice, Dudley and Franklin here https://www.ambientalrisk.com/impact-of-storms-dudley-eunice-and-franklin-in-the-uk/

Obviously, strong winds can damage buildings, the classic examples being slim chimneys, damage from falling trees, and damage to roofs. Clearly, where there is already a weakness, a structure is going to be more susceptible to wind damage. This is also true if a property is in an exposed location.

The question as to whether surveyors should comment on risks of storm damage is likely to be very controversial, but certainly, it is valid for surveyors to advise clients that the existing condition may impact any insurance claim relating to storm damage. The financial ombudsman investigates complaints where an insurance claim has been declined because there’s a dispute either about what actually constitutes a ‘storm’ or whether the damage was actually caused by a storm. In investigating this, they will investigate if the main cause of the damage reported was due to a storm event or if there were other factors that meant the damage might have happened anyway.

Flooding

Flood risk comes from a variety of sources such as rivers spilling into their flood plains, high tides, and storm surges inundating coasts and estuaries, rainfall running off land, drainage systems being overwhelmed or ground water rising from below.

According to the third UK Climate Change Risk Assessment (CCRA3) Evidence Report 2021 (https://www.ukclimaterisk.org/wp-content/uploads/2021/06/CCRA3-Briefing-Housing.pdf)

“Flooding is already a severe risk to UK housing and is projected to increase with climate change. Flooded homes can cause long-term and severe impacts on mental health and wellbeing, alongside the obvious damage to property. This risk is already high magnitude with 1.9 million people across all areas of the UK exposed to frequent flooding from either river, coastal or surface water flooding, and is projected to increase even further in the absence of higher levels of adaptation.”

The risk of flooding to people is considered one of the most severe climate hazards for the population, both now and in the future, with 1.9 million people across the UK currently living in areas at significant risk from either river, coastal or surface water flooding. According to CCRA3 this number could double over the next 25-30 years.

As property professionals, we usually just consider the impact on buildings, but flooding can have a significant impact on those who experience it through:

- Death or injury directly attributed to flooding (currently this is relatively small)

- long-term and severe impact on mental health and wellbeing

- financial implications

- disrupted access to employment, education and health provision

- illness from water-borne pathogens or chemical contaminants arising from floods.

Of course, water can impact a property and its inhabitants in other ways, not just through flood damage. While there is no direct evidence which links other issues directly to climate change, water can have a significant impact on both the property fabric and the occupants. Indoor air quality will impact occupant health and wellbeing and may cause or aggravate allergic and asthma symptoms, airborne respiratory infections, chronic obstructive pulmonary disease, cardiovascular disease and lung cancer.

A flood risk check is an important and established part of the surveyor’s role so a buyer can make an informed choice and obtain adequate insurance cover should they purchase the property at risk.

Flood insurance is possible for a home at increased risk of flooding. Policies do vary but for buildings insurance, cover can include the removal of debris, drying your home over an extended period, repairs to structure, repairs to fixtures and fittings

and legal expenses. For contents cover, furniture, appliances and carpets can be covered.

If a property is in an area which is considered at higher risk of flooding, it can be harder to find a mortgage for the property. However, there are usually mortgage options which will vary depending on the significance of the flood risk, with lenders reluctant to lend when they perceive the property as risky. Lenders may offer to lend but subject to the homeowner having sufficient insurance cover in place.

Some lenders are also more sophisticated at assessing the risk to individual properties even though a location may be identified as being at high risk; this would be where flood mitigation has been considered, for example, if the ground floor of a property is above the ground level.

Flood Re is a joint government insurance industry initiative that makes insurance available and affordable for homes affected by flooding.

Flood Re take on the high flood-risk elements of home insurance and works as follows:

- They collect an annual tax from home insurers in the UK. This levy raises £180m every year that Flood Re use to cover the flood risks in home insurance policies.

- The insurer passes on any high flood-risk part of the policy to Flood Re and takes responsibility for the flood-risk part of the policy. When a valid claim is made against a policy, Flood Re reimburses the insurer from the central fund.

Over time, it is estimated that Flood Re will benefit over 350,000 households by providing access to more affordable policies.

Homes of the future?

As ‘once in a century’ weather events are turning into ‘twice in a decade’ weather events, then it is inevitable that the way we build, adapt, insure and value our homes will have to change and Surveyors will have to adapt the way they report on and advise clients.

We would be interested to hear your views on this and how you are already adapting your practice.