Down Valuations.

CHRIS RISPIN FRICS, DIRECTOR, BLUEBOX PARTNERS

Director of BlueBox Partners, Chris Rispin, explains what the valuer is trying to achieve and what the seller can expect from ‘down valuations’.

Recent media coverage has alleged ‘down valuations’ are stopping some buyers from getting their mortgages sorted. A BBC story in July 2018 say that there has been a “significant” increase in properties being valued at an amount less than the buyers agreed to pay. This means, according to the UK’s largest mortgage advisers, that buyers are having to find the extra money up front to avoid the loss of the property. However, some buyers have been able to renegotiate the price of the property in line with the valuation.

What exactly are ‘down valuations’?

Emoov’s CEO Russell Quirk said that ‘down valuations’ are down to surveyors “simply covering their backs”

But what are they covering their backs against? Is it the buyers to whom the valuer has a duty of care to ensure that the value is supportable in the general market? Is it the seller who is trying to get the best price for the property and to whom the valuer has no tortious duty or contract? Is it the regulator governing the actions of the valuer checking for independence and objectivity? Or, is it the lender who has a contract with the valuer and expects advice in accordance with an agreed specification for a mortgage valuation and who issued thousands of claims in the recent property recession for allegedly “over valuing”?

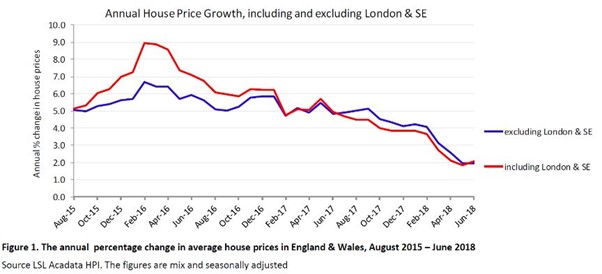

The graph below supplied by LSL Acadata demonstrates the overall impact of house prices. As you can see, various organisations report that asking prices are down in some areas month on month and that sales in some parts of the country are taking longer to achieve.

Consequently, it would be very surprising if valuers were not taking an objective view of the market and considering whether a particular sale price truly reflected Market Value. The crux of the issue lies in the valuer and seller following different rules.

Defining Market Value

Market Value’s recognised definition is as follows:

“Market Value is the estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion”.

Below are the key things that a valuer needs to adhere to in order to comply with both the Regulator and their customer, according to the International Valuation Standards Section 104.

• The estimated amount – this is the most probable price reasonably obtainable on the valuation date. It should be the best price for the seller and the most advantageous one for the buyer. It must exclude special terms or atypical financing or any element that would only be available to a specific owner or buyer.

• The willing buyer – it’s important that they’re not over eager or determined to buy at any price. This buyer is also one who purchases in accordance with the realities of the current market and with current market expectations, rather than in relation to an imaginary or hypothetical market that cannot be demonstrated or anticipated to exist. The assumed buyer would not pay a higher price than the market requires.

• The willing seller – the seller should equally not be over eager to nor considered to hold out for any price. The factual circumstances of the seller are in effect ignored by the definition that puts in place this hypothetical basis.

• After proper marketing – means that it is assumed that the exposure to the market has also been the best possible. There should have been enough time for the asset to be brought to the attention of a sufficient number of potential buyers. Some of this information may not be available to the valuer, but that assumption will be made.

Most importantly, the definition requires that: “the parties had each acted knowledgeably, prudently”, which presumes the parties are reasonably informed. However, they are not expected to act with hindsight, so the hypothetical parties are not expected to anticipate what the market might do.

Most valuers would expect a buyer active in the marketplace to be able to determine good value for the price. However, at the point the mortgage valuation is done, the buyer may be totally unaware of the property’s true condition or any legal matters which may affect the purchase price. Therefore, this is a negotiation based on limited information, and the buyer may well wish to renegotiate when all the information is known.

Equally, the sellers may be unaware of issues that could truly influence the price, particularly if they have used an unqualified or online only agent who may not even have seen the property and therefore has limited knowledge of this particular product. It is hardly surprising that so many sales fall through when the knowledge and prudence is not introduced into the process until the 11th hour!

Valuer’s role

It is the role and responsibility of the valuer to apply a valuation based on specific guidelines. The lender must be able to rely on the valuation, not just for the next day, but for the full term of the mortgage, which could be more than 25 years.

This means the valuer must look at the property from all possible angles. The seller wants to achieve the best price and most sellers/agents will speculate on the market at the outset to see what level of interest there is based on past sales. This is a very different concept to producing an objective valuation.

With this in mind, it’s important to understand that the valuer is not producing a ‘down valuation’, but a realistic Market Valuation based on the market evidence for the subject property. It also takes into account comparable evidence from actual sales of similar properties within a reasonable time frame and in a similar location. Allowance is also made for condition and legal issues, including compliance with Planning and Building Control.

It’s common for agents to skip over whether the property is freehold or leasehold, or how much time is left on the lease. They also tend to neglect potential problems that affect value, such as Japanese knotweed in the garden, or whether the property is suffering from cavity wall tie failure and numerous other factors which the valuer must consider.

A valuer has a duty of care to their customer and must inform them if they consider the asking price unsustainable. The valuer must also consider whether that sale price is repeatable, that is, the person who made the bid is not a sole buyer, prepared to buy at any price in accordance with the definition as stated above.

External appraisals

The media coverage of ‘down valuations’ has also alleged a lack of internal inspection. However, this happens at the instruction of the lender, and is called an external appraisal. It was originally introduced to replace the former Bank Manager driving past a property being considered as a security for a loan, usually in circumstances where the loan was very small, and the property was a good investment for the bank. For fairly obvious reasons the banking industry decided they should have a qualified person to undertake such an inspection, however, this has transformed from being used for low levels of loan to higher ones undoubtedly with the bank’s appropriate risk assessment.

However, it is clear that a valuer is unable to provide the same quality of appraisal as would be undertaken if a full inspection was completed, so inevitably there may need to be a level of caution. The valuer must make a substantial number of assumptions in determining the condition and value of the property, mainly using comparable evidence. The solution is to pay for a full inspection if the valuation is critical.

Assessment v speculation

The valuer is providing a professional valuation based on a recognised set of rules. Sellers and their agents, on the other hand, are speculating at the price that could potentially be achieved. In many cases that price may turn out to be the market valuation, but there will be times when the two are different.

Those active in the market will know when a property is over-priced and some will negotiate the price down. If buyers want more information on the property as a product before negotiating the price, then they must get a survey. Sellers who want to avoid last minute hassle should be asking agents for more details and those with the appropriate qualifications may be able to provide the answer.