Good Valuation Rational (Part 2).

When I was a lad, our maths teacher used to tell us that we could get up to ninety percent of an exam mark for showing the correct working out, with the actual right answer at the end being worth a mere ten percent of the total.

Being the sort of disturbed kid who eventually grew up to be a surveyor, I decided to test this out. In my next monthly maths test, I produced perfect calculations, deliberately entered wrong final answers, and sat back to await my cleverly-contrived A grade. Unfortunately, our maths teacher could sum up idiots just as well as complex numbers, so he gave me a big round zero… For ‘lack of effort’.

Imagine my surprise many years later hearing a judge summing up in a negligence trial and basically peddling the same philosophy. The valuation figure was obviously disputed and there was no rationale (‘workings out’) in the Valuer’s site notes. The Judge was scathing about both the Valuer and the supporting expert when they were unable to satisfy him from the witness box of exactly how much the scant comparables were really ‘better’ or ‘worse’ than the subject property. In fact, the toe-curling embarrassment of hearing property professionals being unable to back up their own opinions in detail was something I didn’t ever want to hear again, and converted me firmly to the merits of Valuers laying out their thought processes right from the outset in clear, detailed site notes. So how should we go about the modern day fusion of art and science?

In simple terms, the quality of your valuations critically depends on the selection of good quality comparables, the quality of your analysis adjustments, and the quality of your thought process and reasoning in arriving at your valuation figure, recorded as your justification.

Well, plus ca change. The technology may have advanced into the realms of science fiction, but the old principles are really the same – a human being with specialist knowledge making very specific and intricate assessments of relative attributes to arrive at a valuation. All that’s changed is the availability of data and the expectation that we will use it in detail, and then record it in a manner that shows we understand it.

To start with, the selection of good quality comparables is key. In a world of identical three bed semis, valuation becomes somewhat easier, but the more unique the subject property, the more searching and thinking we have to do. I don’t believe we need to explain here in great detail that a flat is an unsuitable comparable for a detached house, but when a house sits in a road of bungalows, we need to be clear we should consider widening the net to find other similar houses in other streets, so we can compare housing apples with housing apples.

Selected comparables should therefore match the characteristics of the subject property as closely as possible, within the constraints of available market evidence and geographic location. Ideally they should not differ significantly from the subject in material respects, particularly in terms of type, age, and bedroom numbers. They should also (for estate properties or areas of urban development) be at least in the same locality and ideally within a few streets of the subject property, or in a comparable value area close by. Of course, simply seeking only comparable evidence which supports the figure advised for the subject is not acceptable – all the relevant market evidence should be considered.

If closely matching comparables are not available, then the subsequent analysis and adjustment of the factors of difference of those comparables which are considered is particularly important to relate them to the subject. Generally, where there are more than say three or four areas of material difference, a comparable may be of limited use and alternatives should be sought. A comparables matrix should then be completed fully and legibly, to be acceptable as a data record and provide defence to any subsequent claim.

So far, so standard, I hear you say – but it is at this stage that I believe a little more effort is required.

Subject to RICS Guidance on use of comparables, whilst firms generally and quite rightly follow the processes both they and insurers feel most comfortable with, there is a growing movement to analyse each comparable in depth using lump sum or percentage adjustments (rather than relatively vague terms such as ‘better’ or ‘worse’) in order to compare effectively.

The major concern usually expressed about this approach is that it seems ‘too forensic’. Surely if the lump sum or percentage adjustments are not based on precise market analysis, someone will hold us to account later, won’t they? Well, yes and no. It is true that the adjustments must be founded in reality. In the previous article, Chris Rispin wrote about gathering local data to determine attributes and value differences, but matrix adjustments are ultimately just a way of recording a process that Valuers have been doing in their heads for generations. An experienced Valuer will probably know how much more a semi is worth than a mid terrace in his location without really thinking about it, (although other plus and minus points may require some deeper thought); the less experienced Valuer will, as ever, need to learn their patch by reference to property websites and sales data. So the only thing that has changed with a so-called ‘forensic’ approach is that we are now writing the data down in detail, and showing our thought process.

For the majority of factors (e.g. house type, number of bedrooms, floor area, known or assessed condition, value location, setting and changes in market values over time from the comparable sale date, particularly in a falling market), a percentage adjustment of the comparable sale price based on the surveyor’s experience is often the most suitable way of reflecting differences.

An appropriate adjustment should be made in percentage terms for each of the points of difference, both + and -, based on the surveyor’s experience, recorded individually for each point. For some differences, e.g. with different areas of land or self-contained annexes, or utility rooms and small extensions, a capital figure adjustment, again based on the surveyor’s experience or opinion, might be used.

The following are the most usual points of difference where adjustment might be needed:

- Property type

- Property age

- Overall size, extensions, bedroom numbers (ensure compared floor areas are all on the same basis i.e. GEA or GIA, and net of integral garages)

- Property internal features including ensuites, utility, study, cellar, internal layout

- Garden/grounds, including outbuildings/facilities e.g. pool, tennis court, stabling, workshop/studio

- Condition and state of modernisation; quality of building/specification

- Particular features and appearance e.g. fine views, well-screened plot, high levels of insulation (likely to become more relevant with MEES), mooring rights

- Listed status

- Value location – properties just one or two streets away can be of significantly different values (the location on one particular side of a road may be more valuable)

- Proximity to adverse factors or uses e.g. motorways, rail tracks, known flooding area

- Proximity to, or location in, value-adding local factors/ areas e.g. school catchment area, rail/tube station, lower council tax area, good broadband speed location

- Market changes since date of sale (and possibly changes in value between agreed and completion sale dates in a fluctuating market)

- State of the market

- Special sale factors e.g. quick sale needed for emigration, relative purchasing, repossession sale, sitting tenant, and probate sale. A bidding war between two buyers can inflate a price.

Some points of difference may be too minor on their own to be value-significant, but cumulatively may warrant an adjustment. Therefore local knowledge, or a source of it, is invaluable in knowing if particular factors are relevant, and what adjustments to apply for all relevant factors.

After similarly analysing all the comparables in a matrix, the results may yield reasonable adjusted comparable value range which will either support the sale price/estimated value of the subject or not. (If it does not support the subject value or if the range of adjusted values is wide, then reconsider the analysis of each of the comparables to ensure the adjustments made are reasonable. Then reconsider whether, in the light of the analysed comparable evidence, the purchase price or estimated value does reasonably reflect the current market value after all.)

It is clearly inappropriate to record individual adjustments that are inconsistent or just plain daft; a consistent approach must be adopted. However, a difference of one or two percentage points per attribute from the scientific reality is not going to make a huge difference in an adjustment exercise when an adjusted comparable range is being derived at the end. The point is that the Valuer is engaging in a methodology that can be clearly reviewed at a later date, and most importantly, is following a thought process leading to a valuation figure which is hopefully robust and verifiable via a behaviour that avoids getting it wrong to start with.

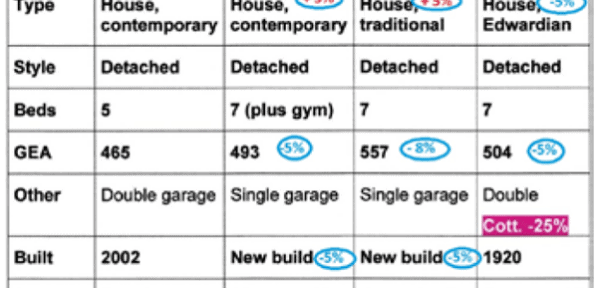

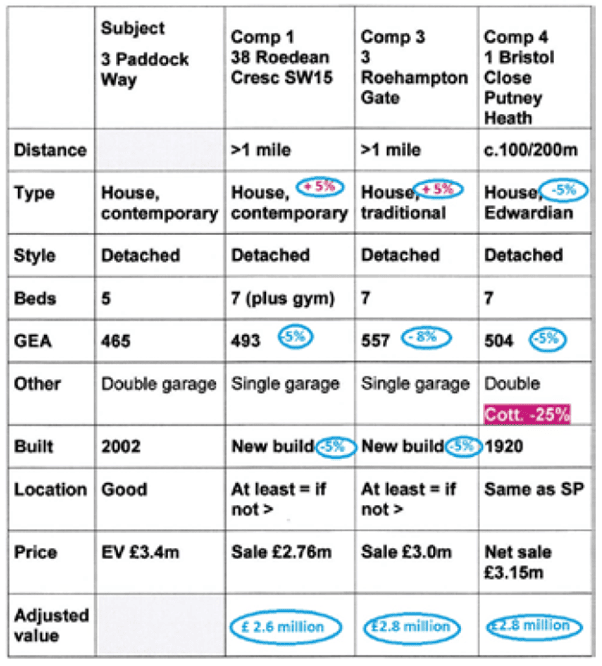

Consider the following example of an adjustment matrix;

The value-relative attributes have been given a percentage adjustment, including kerb appeal. Note the floor areas have not been adjusted by simple proportion since an allowance has been made in percentage terms to reflect the three storey accommodation in some comparables. An allowance of minus 5% has been recorded for new build premium.

An adjusted comparables range of £2.6 to £2.8 million is thereby derived. This indicates a valuation very much below the estimated value of £3.4 million.

This example is interesting because it is derived from the comparables used in the case of Blemain Finance Ltd v E.Surv Ltd [2012] EWHC 3654 (TCC) (20 December 2012), and the summing up of The Honourable Mr Justice Coulson at a true value of £2.8 million. You are at liberty to read the full judgment elsewhere, but the simple application of the matrix adjustment process to the Valuer’s own comparables would have instantly put him on alert that the applicants’ £3.4 million estimate was wrong. In other words, this process could have saved a very significant claim.

Of course, the mechanics of adjustment are not the end point of a valuation process; a concluding justification is required. This is a critically important part of the valuation exercise, where after analysing the comparables, a detailed note should be recorded of the reasoning why the valuation figure submitted was decided on, and with sufficient explanation where the valuation differs from the agreed price or estimated value. Clear demonstration of the ‘thought process’ is required, and is effectively the ‘summing up’ of your efforts which leaves no doubt of your competence.

The detailed written justification for the valuation should include a ranking for each of the comparables considered, with a note of the importance the surveyor attached to them in deciding on the valuation figure.

The justification should typically include (but is not limited to):

- A statement of the adjusted comparables range

- A comment on how the Purchase Price/Estimated Value relates to that range and, if outside it, the implications for the valuation figure.

- An explained ranking of the comparables.

- All other relevant factors which the surveyor had regard to in arriving at the valuation.

- A record of the decided valuation figure.

It should also include when appropriate, as examples:

- A comment and explanation where the Adjusted Comparables Range is considered wider than would normally be acceptable.

- Explanation where any ‘less than ideal’ value-significant comparable factors have been considered – typical examples: significant differences in age, type, size, value location; sales over six months old; ‘for sale’ comps used of necessity.

- Explanation where the valuation differs from the PP/EV

- Where a ‘restricted marketing period’ valuation is requested, adequate explanation and reasoning for the reported figure.

RICS has previously told Valuers that;

- The justification should be a reasoned argument that leads to the conclusion of the valuation itself.

- The Valuer’s justification should be part of the site notes and show the reasoning behind the valuation, demonstrating the relative merits of the subject property compared to the comparables.

- The justification should also include comment on the general tone of the market and the context of the valuation in the market so that it reflects a balance of the evidence.

- The justification could also record the opinions of other professionals whose views are trusted and have been obtained.

- The use of comparable evidence that simply substantiates the purchase price but which varies dramatically from the balance of the evidence in the wider market is to be avoided.

Consider the following justification provided for a valuation undertaken in the summer of 2016;

The subject property is a semi detached house of average size and condition. It includes an average plot and separate garage.

The comps comprise two houses of similar age and type and a further comp of older style. All are in close proximity to the subject but C 1 / 2 in particular are on the same estate as the subject. I have provided a comprehensive write up of each comp, how it relates to the subject, why I have made adjustments and the meristem of the data that was available. This information is given under each comparable’s individual note section on the matrix. As such, this information is critical to my analysis and MUST be reviewed in line with the justification to fully appreciate my thought process.

The range is small (within appx 5% of the decided valuation) and this gives me confidence that the chosen value is reasonable for this property and that the comparables are suitable.

All comparables sourced for this valuation are located within around ¼ of the subject property.

Following the referendum held on 23 June 2016 concerning the UKs membership of the EU, a decision was taken to exit. We are now in a period of significant uncertainty in relation to many factors that historically have acted as drivers of the property investment and letting markets. Such circumstances are unprecedented but are expected to result in similar uncertainty in much of the property market. Since the referendum there’s been little or no empirical evidence of market activity upon which to base our opinion(s) of value, resulting in a reduced level of certainty that can be attached to our valuation.

The market for this type of property in this area has lost momentum and I don’t expect values to change significantly in the near future.

How does the chosen value relate to the ACR? Does it follow the comparable ranking?

I have not observed satisfactory evidence to be convinced of a market reversal, particularly in an area such as this where demand is typically very strong but the evidence here is pretty compelling in showing the agreed pp for this property is below that which would be expected. Interestingly it was actively marketed for £325,000 yet is being sold for £315,000. This represents less than five percent lower value so fairly negligible.

Having considered the comparable evidence and marketing I have decided to value at the agreed pp of 315,000.

Clearly at the time (not long after the 2016 EU referendum) there was some uncertainty in the market, and the justification is therefore tailored to suit. There is a description of the property, the comparables and their relativity, the adjusted comparable range, and the proximity of the comparables to subject. Critically, the Valuer has identified that market conditions are potentially uncertain, included a ‘Brexit’ clause, and has thoroughly detailed the property market as he sees it at the date of valuation. Whatever the accuracy of the valuation figure, I think you will agree that it would be hard for a barrister to imply that this was not the methodology of a reasonably competent practitioner.

I appreciate that some would be horrified at the thought of providing this level of detail for each and every valuation. The good news is that the content need only be proportionate. A slack market with little activity should be mentioned in the summary, but if there are three excellent identical comparables to back up your figure, then the justification text can be trimmed to suit. However, there must always be a justification, no matter how direct the comparable evidence and no matter how confident you are in your figure. A proper justification is an integral part of the modern valuation process, and your insurers and the courts expect to see it, to say nothing of your client and their auditors.

Now that I’m no longer a lad, I have occasionally been asked by young Valuers answering their first contentious post valuation query or complaint whether I think any legal implications of their responses should be considered first. I normally reply that residential valuation is not supposed to be a process of self-protection for its own sake… after all there is always a client who expects the very best of advice, not the very worst of a caveated process to mask a lack of knowledge. All that aside however, I often then go on to say that if they really do want to consider the legal implications of their valuation work, then the time to do it is before they submit the figure.

There is always more than one way to conduct the dark art of residential valuation, and even more opinions than methods. But remember, Valuers will continue to be challenged retrospectively, and sometimes unfairly, so in the absence of firm evidence in your defence, barristers will instinctively try very hard to interpret your thought processes as they think they should have been. Why not eliminate vagueness, nail your professionalism to the mast, and write down your analysis, adjustments and justification boldly on your site notes? At the very least, you’re getting your defence in early. Using a behaviour that drives a greater chance of getting the figure right in the first place, which is surely what both we and our clients want?

My maths teacher was right… it’s all about effort.

Giles Smith, Chief Surveyor and Technical Director, SDL Surveying