Good Valuation Rationale (Part 1).

Why it pays to be prudent

Companies spend thousands of pounds auditing work undertaken by valuation surveyors to ensure that it is being carried out in a professional and accurate manner. These companies are both property related clients and surveying practices. I am sure a number of readers will question the validity of auditing in the first place. What value or benefit does it actually bring and is it a wasted expense that could be avoided? However, read on because for valuers it could be a form of protection. This is an introductory article leading to a number of others that will go into more detail on the methodology used in some practices to produce the methodology that will provide a robust valuation.

The high level of cases that were directed against valuers during the 90’s and indeed in more recent years, together with a number of quite high profile cases stretching back to Yianni v Edwin Evans and Smith v Bush in the 80’s, would suggest that the methods adopted by valuers are not always right.

Add to this is the problem of high levels of fraud within the property industry over the last couple of decades, where in many cases valuers have been “tricked” into falling for the fraudsters gambits.

Vast sums of money can be made from valuation fraud and those involved are capable of quite sophisticated methods to achieve their aims. So in a very important way auditing is a form of protection, an assurance to all involved that the valuation process adopted is robust and not tainted by the unscrupulous, who have significant funds and rewards if they get their way and who see the minnow, in the form of a small independent surveying practice, as a prime target for easy fishing.

As with any potential for fraud it pays to be prudent and take some precautions; many practices have already introduced new systems that provide comprehensive valuation rationales, with numerous checks and balances in place.

Of course, technology can provide many of the answers, rather like a “big brother” watching over the activities going on in the property market place. There is much more information available now to the valuer to help identify the transactions that have taken place, when and at how much. Consequently, a failure to engage with those web based systems or to do the equivalent manually would be regarded as a serious shortcoming.

I have seen systems that superimpose recorded sales of property onto a map and track those sales over a period of time. This can then very easily highlight sales that fall out of line. Similarly, this is being achieved by using the ‘black box’ of the automated valuation model to monitor sales and predict values.

However, such systems do have limitations – not all property has sales evidence, the black box doesn’t have “eyes and ears” and cannot accommodate issues with condition, alterations and it struggles when the subject property is unusual and has few direct comparables.

DAC Beachcroft recently commented upon the case of Barclays Bank Plc v Christie Owen & Davies Ltd (trading as Christie & Co) [2016] EWHC 2351 (Ch)

Where Christie & Co denied it was negligent. The parties and their experts (both valuation and lending) were unable to agree on many issues in advance of trial meaning the court had many things to consider and the judgment was lengthy. As appears increasingly to be the fashion, the court did not prefer one valuation expert over the other, but instead considered “the weight to be placed on different aspects of [the experts’] evidence…and then [reached] its own conclusion”. Respective experts were, therefore, preferred on some points whilst the Judge went with his own views on others, an outcome likely to give a few sleepless nights to anyone trying to advise a client as to the merits of a valuation case.

There are a few concerns here. The wording – “increasingly the fashion” for the Court to pick and choose from the evidence presented is particularly of note. On what basis do the Courts believe that they are in a better position to make a decision on value than all the professionals who have been involved in the case? We as Surveyors and Valuers should not allow the Court to be in such a position. At the outset we need to ensure that we have provided a robust validation of the valuation that we have produced.

So where can the Valuation Surveyor add value and reduce vulnerability? Here views vary on what method should be adopted and how far is it necessary to go to produce that validation. There is one view that the supporting notes should transparently set down – how the valuation has been produced so it is clear for all to see. An alternate view, in particular held by some, but not all, in the legal profession (and the writer has personal experience of this), is that a degree of ambiguity is helpful and a lack of transparency is to be recommended otherwise it can clearly be seen when the valuation surveyor has got it wrong.

I think the argument here is that no-one intends to get it wrong and the intention is to ‘set it all down clearly’ so that the component parts of an accurate valuation can be supported by evidence. It makes for a better night’s sleep and a feeling of self-esteem that a good job has been undertaken to support what the customer needs.

On a continuation of this theme, there are those who rigorously determine the attributes of the comparables and determine the value that can be ascribed to each attribute so as to produce the positives and negatives of each comparable. They then adjust the values of the comparables to produce a true reflection of supporting evidence that proves the value of the subject.

So a valuer finds 3 similar styled comparables all within the same neighbourhood, one has a double garage and the subject property has a single one. Another comparable has a conservatory and the subject property does not, and the final comparable is similar to the subject but is not in as good a condition.

So the double garage is a positive and to make the comparison the value of the additional garage has to be deducted. Similarly, on the second comparable the value of the conservatory has to be deducted as it is a positive attribute. However, for the third comparable it has the negative attribute of being in a worse condition, so a figure has to be added to the comparable to bring it up to the same standard as the subject. This is shown in a simple matrix below. It should be noted that this matrix does not show all the attributes that may be considered, however as a summary to establish ranking and demonstrate key variables it helps “see the wood for the trees”.

Simple Matrix

| Address | Type | Beds | Date of sale | Price £ | Size GEA m2 | Garage | Condition | Age | Distance from subject | £/m2 | Variables £ | Variable attribute | Adjusted value |

| Subject | SDH | 3 | Jan 2017 | 210,000 | 89 | 1 | AVG | 1955 | 0 | 2360 | 0 | 0 | |

| 33 Acacia Ave | SDH | 3 | 20/10/16 | 220,000 | 91 | 2 | AVG | 1953 | 200 | 2418 | -10,000 | Garage | 210,000 |

| 21 Oak Road | SDH | 3 | 01/09/2016 | 215,000 | 100 | 1 | AVG | 1955 | 150 | 2150 | -7,500 | Conservatory | 207,500 |

| 10 Willow Cres | SDH | 3 | 23/09/2016 | 185,000 | 89 | 1 | Poor | 1954 | 250 | 2079 | 25,000 | Condition | 210,000 |

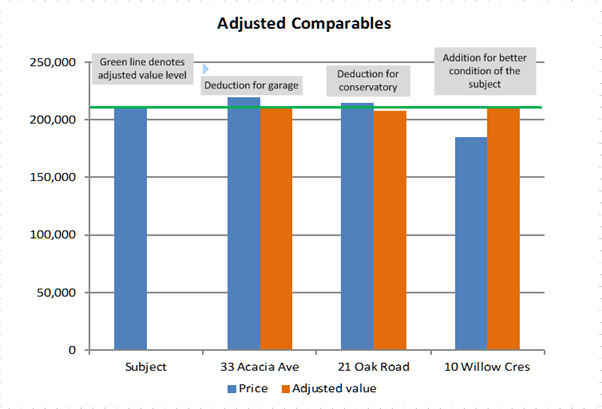

Using a spreadsheet for the matrix this can then be shown on chart like the one below to see how the adjustments prove the valuation of the subject property. Valuation rarely has so few variables and the complexity is knowing how much to adjust the figures.

Chart

The critics ask how are the attributes valued as precisely because this is not a true reflection of what buyers do in the market place.

On this latter point the RICS definition of Market Value requires the valuer to consider that both buyer and seller are, among other things, “knowledgeable and prudent”. This is usually hypothetical as the buyers are lay people and not trained in valuation or building pathology. Their knowledge comes when it is pointed out by the expert valuer. Their prudence comes from the deposit they can raise together with the mortgage funding they are allowed based on their salary. They have an overwhelming desire to buy a property that appears to suit their needs. So if the expert says to the buyer that one property is more expensive because it has a double garage as opposed to a single one, then it is fairly logical to explain that this difference in value is a real figure and not an intangible comment that it is “better”. If subsequently disputed it will be left to experts to thrash it out and they will produce a figure, which is not an ideal plan.

How much the figure is comes with the experience of working in the area and knowing the variances for certain attributes. That is not an easy exercise and only comes with hard work in observing the market place over the years and building a database that demonstrates such variables. If it was easy then the technologists would produce a computer model to do it. The real reason they have not is that there are no databases in this country that collect sufficient data to make the granular analysis that differentiates the valuer from the machine. Some valuers maintain this sort of information in their heads and some struggle to put the rationale down on their site notes, but that is what is now required. See the RICS Information Paper 1st edition “Comparable evidence in property valuation” for more guidance.

The more unique the property with fewer comparables, then the harder it becomes to provide a purely scientific approach There are an increased number of variables i.e. some properties at a higher value will have more features, such as increased number of ensuite bathrooms, a study, larger garden or possibly a gym to reflect an increased level of buyer preferences and affordability. However, the science provides the benchmark upon which the “dark art” of residential valuation can be applied.