Professional Consultant’s Certificate.

What are they and when are they used?

The case of Hart v Large has caused a lot of consternation in the surveying industry in recent months. One aspect of the case was the failure of Mr Large to be crystal clear about obtaining a PCC, which was essential.

In this article, we look at Professional Consultant’s Certificates, what they are and why they will be essential for some clients.

A new-build warranty is designed to protect a purchaser against any defect or construction deficiency, usually for the first 10 years after the property has been completed. Also, lenders will usually require a new build warranty as a condition of providing mortgage finance (this is covered in the handbook of UK Finance, previously the Council of Mortgage Lenders.)

The warranty is provided by the developer to cover the purchaser in the event that:

- The developers were to go out of business prior to completion (in which case the buyer’s deposit is secure)

- Defects and deficiencies in the construction

Probably the most familiar new-build warranty scheme is the National House Building Council’s (NHBC), Buildmark. This is in effect a two-year builder’s warranty and a further eight years’ insurance. It runs from the date of completion. Buildmark covers approximately 80% of the new-build market.

But there are other new-build warranty schemes in place – the most well-known being Local Authority Building Control Warranty (LABC) and Premier Guarantee. Zurich also previously provided warranty cover in this market. These schemes all operate under the Consumer Code for Home Builders.

These warranties run for 10 years and because they are taken out by the developer in the first place, the benefits transfer to new owners in the event that the property changes hands during the 10 years.

Of course, not all ‘new-builds’ are built by larger housebuilders. There are self-builds and much smaller developers. The Federation of Master Builders (FMB) has a warranty scheme operating under a different consumer code to the NHBC, LABC and Premier schemes, and there is also a Checkmate warranty scheme that operates under yet another consumer code: Consumer Code for Builders of Homes for Sale.

All the above cover new homes, but what about where an existing home has been substantially altered? This is where a Professional Consultant’s Certificate can come in.

What is a Professional Consultant’s Certificate?

A Professional Consultant’s Certificate (PCC) confirms a property has been built or substantially altered in accordance with drawings and instructions approved under building control, or the building contract.

UK Finance state that the purpose of the PCC is to confirm to the lender or its conveyancer that a professional consultant:

- has visited the property during construction to check its progress, its conformity with drawings approved under building regulations and its conformity with drawings/instructions issued under the building contract;

- will remain liable to the first purchasers and their lender and subsequent purchasers and lenders for the period of 6 years from the date of the certificate;

- has appropriate experience in the design and/or monitoring of the construction and conversion of residential buildings; and

- will keep a certain level of professional indemnity insurance in force to cover their liabilities under the certificate.

A PCC can only be issued by a consultant with the appropriate qualifications listed in the UK Finance lenders’ handbook. This is usually the architect associated with the project, but the UK Finance list also includes Chartered Surveyors, Chartered Structural Engineers, Chartered Builder and Chartered Building Engineers. A PCC usually lasts for 6 years and is not an insurance policy – just a statement of confirmation that a house has been built in accordance with the approved plans. In turn, a PCC must be covered under the PI insurance of the party issuing it for there to be any guaranteed protection.

A Structural Warranty is something different again. This is an insurance policy that protects a homeowner against any latent defect in a property and usually runs for 12 years.

A PCC would be needed if a homeowner is selling a property and the purchaser needs a mortgage, a homeowner is re-mortgaging against the property, and if a homeowner wants to rent their property and they need to raise a Buy-to-Let mortgage to release equity.

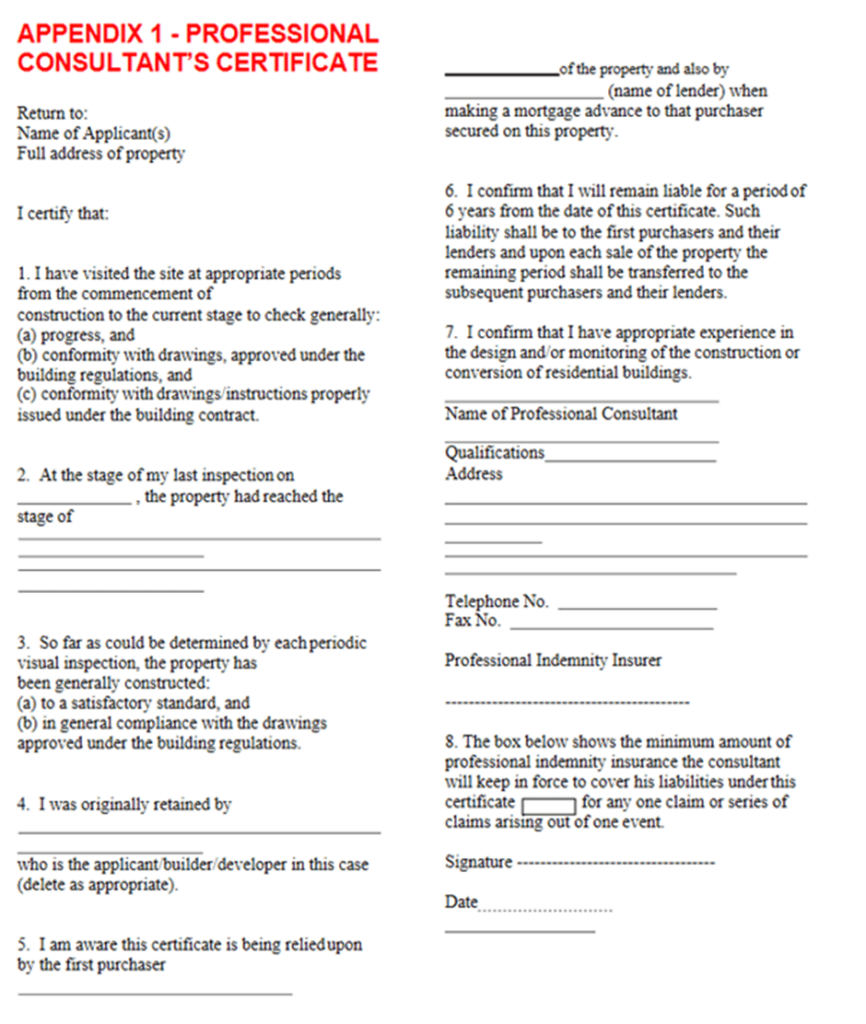

What does a PCC look like?

The UK Finance website includes a link to download a template PCC. This is what you can expect one to look like: