The Valuation of Leasehold Properties for Secured Lending.

The RICS recently published a new guidance note: “Valuation of Residential Leasehold Properties for Secured Lending Purposes”. This guidance note, which covers England and Wales, is effective from 1 July 2021. In this article, we look at this new publication and discuss some of the implications for valuers undertaking secured lending valuations.

Why do we need a new guidance note?

The difficulty with leases is that they are, by definition, a depreciating asset. From the day that they are created the clock starts ticking, and at the end of the lease the subject property reverts to the freeholder leaving the leaseholder with nothing.

Of course, the length of many residential leases are for such a long period of time that they are treated in a very similar way to freeholds – a 999-year lease is as far into the future as the Battle of Hastings is in the past. Up until recently, we would not have given this a further thought, particularly as the ground rents on those leases were minimal and were often not required to be reviewed for the entire period of the lease. However, some developers saw a way of retaining an interest in sites and making additional profit by selling houses and flats on a relatively short leasehold basis. Many of the homeowners affected had little or no idea of the implications of being a leaseholder rather than a freeholder which has led to the recent bad press around leasehold properties. In addition, the leases, as well as being shorter, were set up with rapidly escalating ground rents together with other clauses that may have a material effect on value, meaning that lenders are more sensitive to the potential risks associated with leasehold property. Valuers can no longer rely on very general assumptions around lease clauses and must give ‘proper consideration’ to material matters that will have an impact on value. In answer to this, the RICS has launched a guidance note to assist valuers who are undertaking valuations of leasehold properties for secured lending purposes.

How is it structured?

The new guidance is divided into 8 sections or chapters:

- Introduction

- Background

- Legal responsibilities

- Diminishing lease terms

- Restrictive covenants and planning agreements

- Other factors affecting value

- Guidance for conducting a mortgage valuation of a leasehold property

- Summary

The scope of the document is covered under section 1.1 and it makes the following clear:

- The document covers valuation for secured lending purposes only

- It provides a supplement to the Red Book Global Standards and the UK national supplement.

- It is directed at properties that are likely to qualify for rights under the leasehold reform legislation (e.g., the Leasehold Reform Act 1967 and the Leasehold Reform, Housing and Urban Development Act 1993), but not at properties that this legislation does not cover.

- It is applicable where the term of the lease is 55 years or longer (usually for a term less than 55-years a lender will have specific instructions).

Changes to the regulatory framework

There is a lot currently going on in the world of leasehold property and you might question why the guidance was published now instead of postponing publication until there was more certainty. But in truth, it has been in preparation for some time, and though a lot is happening, there is the need for guidance now in response to the changes in lender expectations.

So, what is happening? In late 2017, in response to the extremely bad press around the issue, the government announced plans to tackle the growing problem of newly built houses sold as leasehold rather than freehold, and to limit ground rents on new lease agreements.

The Law Commission picked up the baton and looked at leasehold reform with the aim of finding ways to make buying a freehold or extending a lease “easier, faster, fairer and cheaper.” In the two years between July 2018 and 2020 it went on to publish ten consultations and subsequent papers on this topic alone. This included recommendations on enfranchisement, commonhold and ‘right to manage’.

In January of this year, Robert Jenrick, the Secretary of State, announced that leasehold reform would be tackled through two pieces of legislation.

The first of these is The Leasehold Reform (Ground Rent) Bill, introduced in the House of Lords on 12 May 2021. This Bill aims to fulfil the government commitment to “set future ground rents to zero.” The provisions will apply to leasehold retirement properties, but not before 1 April 2023.

But future legislation is planned, and the government has announced that this will:

- Reform the process of enfranchisement valuation used to calculate the cost of extending a lease or buying the freehold.

- Abolish marriage value.

- Cap the treatment of ground rents at 0.1% of the freehold value and prescribe rates for the calculations at market value. An online calculator will simplify and standardise the process of enfranchisement.

- Keep existing discounts for improvements made by leaseholders and security of tenure.

- Introduce a separate valuation method for low-value properties.

- Give leaseholders of flats and houses the same right to extend their lease agreements “as often as they wish, at zero ground rent, for a term of 990 years”.

- Allow for redevelopment breaks during the last 12 months of the original lease, or the last five years of each period of 90 years of the extension to continue, “subject to existing safeguards and compensation”.

- Enable leaseholders, where they already have a long lease, to buy out the ground rent without having to extend the lease term.

In addition, the government has said that responses to the Law Commission’s recommendations on enfranchisement, commonhold and right to manage will be issued “in due course” and translated into law “as soon as possible”. This is likely to take at least another year with legislation not before the third session of this Parliament.

But that is just the legal framework around leases. Of course, the other major issue is the safety of buildings following the Grenfell Tower fire, and other legislation that will impact leasehold property are the Fire Safety Act 2021 (enacted in April 2021) and the Building Safety Bill.

It would be easy to dismiss these as irrelevant since they were both introduced in response to the Grenfell tragedy. However, while the Grenfell flats were predominantly social housing, these two bills are not aimed solely at social housing providers.

Prior to the Fire Safety Act, fire safety legislation was covered by the Regulatory Reform (Fire Safety) Order 2005 which brought together different pieces of fire legislation. It applied to all non-domestic premises, including communal areas of residential buildings with multiple homes. The Order designated those in control of premises as the responsible person for fire safety, and they had a duty to undertake assessments and manage risks and were enforced by Fire and Rescue Authorities.

The Fire Safety Act takes this further, clarifying that for any building containing two or more sets of domestic premises, the Order applies to the building’s structure and external walls (which includes doors and windows in those walls, as well as things attached to them, such as balconies), and any common parts, including the front doors of residential areas.

The Building Safety Bill is a very meaty document and merits an article on its own (we will inevitably come back to this) but in essence, it will apply to “higher risk” buildings – that is all multi-occupancy residential buildings where the floor of the top storey exceeds 18 metres or the building has more than 6 storeys (ignoring any storeys below ground level) in England, including student accommodation. It also introduces a stricter safety regime with the introduction of a Building Safety Regulator, and new duty holders.

The lenders

Time was you never heard anything about residential leases on the mainstream news channels, but now, for all the reasons discussed above, leasehold property is much more prominent. And with that come changes in lenders’ sensitivity to risk that may be associated with leaseholds.

It may be stating the obvious, but we must remember that the lenders are businesses, obtaining the money they pass on to purchasers as mortgages either from customer deposits (typically building societies and credit unions), or from borrowing money themselves in the money market. The interest rates that they charge are usually linked to the underlying Bank of England rate or the London InterBank Offered Rate, or LIBOR (LIBOR is a benchmark interest rate by which major global banks lend money to one another in the international interbank market for short-term loans).

Whilst the mortgage market itself was deregulated, mortgage lending is not. Banks and building societies have always been closely regulated, but in 2004 mortgages as a product became the subject of statutory regulation (before that between 1997 and 2004 the Council for Mortgage Lenders [CML] operated the CML Mortgage Code as a voluntary system of regulation) when the Financial Services Authority, now known as the Financial Conduct Authority [FCA], implemented a regime established under the Financial Services and Markets Act 2000 for regulating mortgages to homeowners.

That said, different lenders will have a slightly different approach to ‘risk’. For instance, a building society such as Nationwide that invests the savings of its individual customers is going to be more ‘risk averse’ than say a private limited company, such as Pepper Money, that is also authorised and regulated by the FCA but which has a business model that aims to fill different sectors of the market than Nationwide. Both are regulated and both have to manage the risks with their lending – and in order to do so they must have a greater understanding of the risks involved. Hence the new guidance note.

As these various pieces of legislation work their way through the parliamentary process it is likely that very quickly this first edition of the guidance note on valuing leasehold residential property will need revision.

What does this mean in practice?

In essence, what the guidance note is saying, is that a 2-bedroom flat might not be a good comparable for another 2-bedroom flat just because it is a 2-bedroom flat with almost identical ‘amenities’.

Instead, it is saying that although in the past we may have got away with making the sweeping assumption that both shared the same ‘features’ that have a material effect on value, now we cannot take that cavalier approach. Instead, the valuer must make ‘reasonable efforts’ to ensure that those features are also comparable (though the guidance note does make it clear that the valuer is not expected to go beyond the scope of the inspection as described in the Red Book Global Standards).

So, what are some of the features that might have a material effect on value?

The term of the lease

Since leases are depreciating assets, it is a fair working hypothesis to assume that the value of the leasehold interest will decrease as time moves on and the end of the lease gets closer. Therefore, and using the example of two (on the face of it) very similar 2-bedroom flats, the question has to be, do they have a similar unexpired lease term or are the unexpired lease terms for both properties such that the impacts on market value is comparable?

To answer that question, the valuer has to find out what the lease term of the subject property is (and indeed, whether it has been extended). The guidance makes it clear that the valuer should make ‘reasonable efforts’ to find out what the details of the lease are and only fall back on ‘assumptions’ when reasonable efforts have failed. While the guidance does not specifically say what ‘reasonable efforts’ are, it does state that the information should be ‘readily accessible’, and that the valuer does not have to make ‘detailed legal enquiries’ (See Note at the beginning of Section 2 of the guidance note and Section 2.6). This suggests that information provided by an agent, or the owner, would be deemed ‘reasonable’, though of course, that information may not be accurate. The implication of this is that valuers should be careful to record the source of such information and what, if any, actions were taken to check it. Rightmove have suggested that they will look to include this information in the surveyor comparable tool where it is available to them.

The guidance also says that dependence on assumptions is to be ‘avoided’. This suggests that in some cases assumptions might be acceptable but again, if they are used, should be justified in the valuation rationale with a record made of why assumptions were used.

The ground rent and the provision in the lease for review of that ground rent

Historically, residential ground rents have been relatively modest, from a ‘peppercorn’ to a few hundred pounds per annum. However, the ‘ground rent scandal’ of a few years ago, when it emerged that some new flats and houses had been sold with clauses whereby ground rents would rise dramatically in later years along with the packaging and disposing of those ground rents by the original developer, changed that, and particularly changed the consumer’s attitude to ground rents.

Some homeowners found themselves stuck in properties with escalating ground rents because, understandably, purchasers would opt for a freehold over such a financial burden. By definition, such ground rents had a detrimental effect on the value.

The guidance, therefore, makes clear that the valuer must determine if the ground rent (and in particular how and when it is reviewed) will have an adverse effect on value. This is not a ‘one size fits all’ issue – what might be deemed as having a particularly adverse effect in one area might be considerably different in another. The ‘local market’ will determine this.

Again, information relating to the ground rent will be sought from the agent or owner and again the valuer needs to record this. Local knowledge is likely to play a part as to whether the valuer deems the information provided as reliable or risky and in either case apply the appropriate assumptions (that the information is accurate or otherwise) pending legal advice. Sometimes the valuer may potentially withhold a valuation until the full details from a reliable source (such as legal advisers) can be determined.

This information is also relevant as lenders will refuse to lend on properties where the passing ground rent exceeds a certain percentage of the value of the property.

Any restrictive covenants in the lease that might impact what a person can or cannot do in the property

A restrictive covenant may impose significant restrictions on what can and cannot be done in a property. Often such covenants are sensible, preventing illegal activity, for example. After all, few people would want to be neighbours with a brothel, but sometimes the covenant might have a significant local impact. The example given in the guidance is where a property has a covenant restricting subletting. In an area popular with private landlords and with a dynamic private rented market, such a covenant could have an impact on the value. Elsewhere it might have no effect whatsoever.

Some modern leases restrict the erecting of say, a greenhouse, garden shed or conservatory without first seeking the consent of the freeholder and apply onerous charges to seeking such consents. Clearly, if a garden is small this is unlikely to impact the value since there would be nowhere to put such a structure, but for a family home with a good garden, this could impact the value. Again, the local market will determine this.

Compliance with regulation

As we have already seen, the safety of the buildings in which we live is no longer to be left to chance. Linked to increased regulation is the compliance with that regulation.

Once the Building Safety Bill becomes law, there will be a clear regulatory framework for those buildings in scope, with rights and obligations on various parties involved (from building owner to the occupier), a building safety regulator and rights of redress via the criminal justice system.

However, not all multi occupational buildings will be in scope and it remains to be seen how the improved regulation of those buildings deemed high-risk (in terms of occupant safety) will impact other multi occupational buildings.

In the meantime, a well-managed building or estate is going to be a better place to live in theory, as there is a potential cost involved which we will look at next – and the guidance says that valuers should consider the impact on ‘value and marketability’ if it seems a freeholder is failing to fulfil their obligations.

Such obligations are likely to include fire risk and alarm maintenance, health and safety generally (which could include keeping means of escape clear, dealing with fly-tipping, vermin control etc.), control of asbestos etc.

How maintenance work is handled, the costs associated with those works, and service charges

Freeholders will usually charge leaseholders a service charge to recover their costs in providing services to the building or estate. The way in which the service charge is organised (for example, what it covers and how it is worked out) should be set out in the lease and you would usually expect it to cover things such as general maintenance and repairs, buildings insurance and, where relevant, central heating, lifts, porters or security staff, lighting, alarm systems and cleaning of the common areas etc.

A service charge may also include a contribution to the costs of management services provided by the freeholder (such as from the managing agent) and sometimes contributions to a ‘reserve fund’, sometimes called a ‘sinking fund’, which allows for future expenditure.

Service charges may be fixed – that is the exact amount payable, and any regular increase or review is set out at the beginning of the lease term – or variable where they may change from year to year depending on the expenditure the freeholder may have. Sometimes that expenditure may be capped, but sometimes it might be open-ended. Clearly, from a freeholder’s perspective, a variable service charge is preferable since it enables them to recover unexpected or sharply rising costs. (That said, the amount a landlord can recover is limited to covering only the cost of works that it was reasonable for the landlord to undertake and that are completed to a reasonable standard. A leaseholder can challenge a service charge that it considers is unreasonable.)

From a leaseholder’s perspective a variable service charge is uncertain (even if the repair is reasonable) and, if the household budget is tight, can mean there are affordability issues. Despite rights to challenge onerous service charges, this will be time-consuming and likely to bring unwanted hassle.

If a block of flats, for example, is well managed with a transparent service charge policy and a well-managed reserve fund then, in theory, this will be an attractive proposition for any incoming leaseholder. However, if the opposite is true and there is the risk of the leaseholder having to share the burden of unforeseen maintenance, then this could have a seriously detrimental impact on future saleability and value.

This is well illustrated in the case Cypress Place and Vallea Court, Manchester –v– Pemberstone Reversions. The case involved a company, Pemberstone, which owned the freehold of two blocks of flats in Manchester which contained over 300 flats.

It turned out that these blocks were clad with a material that failed to meet fire safety regulations imposed after Grenfell. Pemberstone added a £3million cost of replacing the cladding to the leaseholders’ annual service charge, meaning each flat owner had a bill of £10,000. Included in this was a “waking watch” charge, for 24-hour security in case there was a fire before the dangerous cladding was replaced.

The leaseholders challenged Pemberstone’s right to recover the cost of replacing the cladding.

This went to the Land Tribunal which found that both the interim fire safety measures (including the “waking watch”) and the costs of replacing the cladding were service charge items and therefore recoverable as a matter of contractual right by the landlord from the lessees.

If the lease states that the landlord had retained ownership of the property’s common areas, including its exterior, structure and external parts then, if the replacement cladding falls within the definition of repair or maintenance of the building, the landlord will have a responsibility to replace any cladding on the exterior that is deemed a fire risk. If a landlord chooses not to act, then it could be found liable to the tenants and their visitors in the event a fire should occur. This is a problem encountered by many leaseholders and freeholders following Grenfell – whether a freeholder is able to recover the cost of repairs/improvements and the extent to which they are able to do so will always depend on the terms of each lease.

Since the valuer is not expected to scrutinise the lease in detail (and is probably not qualified to give an interpretation of such scrutiny) the exact details of the rights and obligations under the service charge are unlikely to be known unless through previous direct experience (such as being involved with another leasehold property in the same block) or good local knowledge (perhaps via a solicitor who acted for another leaseholder). Therefore, it is likely that the valuer will have to apply some assumptions to both the property being valued and any comparables being scrutinised.

Those assumptions should be appropriate and recorded. For instance, if a flat is within a 1930s block, it might be reasonable to assume that the block is likely to need roof repairs at some point in the foreseeable future, whereas a similar block only 10 years old might not. Could this have an impact on the value of that flat?

Valuers should also take care where the property concerned is a shared ownership property as the service charge may also include the rental element for the part retained by the Housing Association or other provider.

The valuation

As with all valuations, the best comparable is going to be most similar and require the least adjustment (in the type of construction, size, location, amenities, lease terms, length of lease etc.). In reality, the lease is going to add a level of complexity, variation and possible additional reasons for adjustment over freehold property.

The guidance takes the following approach: –

- Start by considering comparables that have the same physical attributes as well as tenure.

- Then consider properties with the same physical attributes but differing tenure (a recent sale with a shorter lease is a better comparable than making an ‘artificial’ adjustment to a lease term).

- Next consider properties with similar tenure but different physical attributes.

- Then consider ‘less similar’ properties.

- Finally, the valuer should review the market to check that the valuation is ‘logical in that context’.

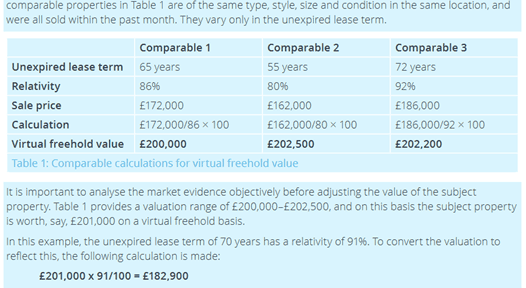

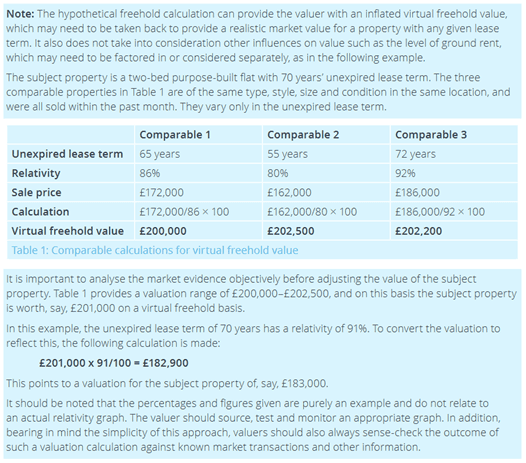

The final tool is for the valuer to understand how, in their local market, the concept of ‘leasehold relativity’ works.

This is the mechanism whereby it is possible to apply a multiplier to a lease to compare it to a hypothetical freehold. To do this you need to collate the value of leasehold valuations in a given market to determine the relativity to the theoretic freehold value. This is expressed as a percentage.

Below is the example from the RICS guidance note:

Conclusion and summary

The valuation of leasehold property for secured lending is getting more complex, a trend that we see lasting for the foreseeable future. It is also relatively volatile, being politically and socially sensitive following Grenfell and the leasehold scandal.

Valuers will have to make all reasonable efforts to find out more about the leases of the properties they are both valuing and using for comparables and, crucially, clearly recording the sources of information and assumptions derived from it.