Undertaking Investment Valuations.

Are Valuers asking the right questions when undertaking Investment Valulations?

The significance of how property differs as an investment from the more usual forms, such as shares in companies, was evident recently as the penny dropped for some making more noise than Big Ben chiming 12 noon.

It was reported in the The Times on July 8th 2016 that investors in property funds were surprised that fund managers were continuing to collect their fees on the funds even though the managers had suspended withdrawals to prevent a firesale of the underlying assets due to the Brexit vote.

The explanation is that the property investments still incur costs as the properties still need to be managed, valuations are undertaken and properties traded, which all incurs a cost. The fact that such investments are tangible assets, occupied by humans and machines, their condition deteriorates and have numerous costs, seems to have passed by some investors.

There is a strong argument that the market has determined the value of such properties and therefore why question using owner occupier comparables. However, Valuers have a duty under the mandatory requirements of the Market Value definition to assume that both the buyers and sellers are acting “knowledgeably and prudently”. This in essence supports the purpose of an independent and objective valuation process so that illogical, misinformed, special or misguided transactions should be questioned.

This of course is not only true for the commercial properties managed by the big investment funds, but is equally true of residential investments, now better known as Buy to Let investments. Since their inception many investors and Lenders have treated them on equal terms to owner occupied property, but as Government has imposed more impositions partly in the way of taxes and the product rules change, then a true risk assessment should be undertaken on behalf of a buyer and Lender.

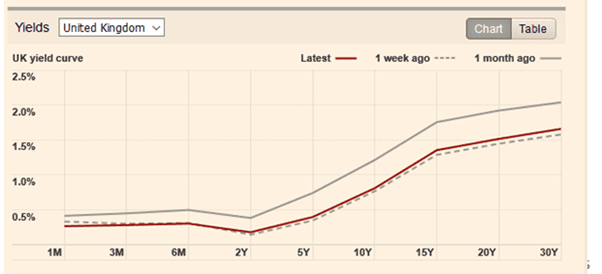

In many ways the failure to understand that property is not like investing in Shares or Bonds indicates a fundamental point with the Market Value definition in that the Buyers are not acting either knowledgeably or prudently so it is a hypothetical situation. A true analysis of a residential investment often demonstrates that the basic net return does not support the investment if the cost of borrowing is taken into account. However, for investors in it for the long term then the capital appreciation of the property has generally resulted in an adequate return. However, this is speculative and it could be argued that for a residential valuation undertaken under the Red Book mortgage specification that speculation has no place in such a valuation. Investment rates, at the time of writing, in the UK are particularly low and have been for some time. The graph (Source: Financial Times 13th July 2016) shows where Government Bonds stood at that time taking into account the events of the previous month which included the Brexit vote. These rates are considered the benchmark for any investment calculation and whilst they are so low it is understandable that residential investment property even with its additional costs begins to look attractive, especially if the investor is in it for the longer term. The downside to that aspect is that if the property is old in the first place and possibly beyond its original design life, such as a Victorian terrace, then the costs are likely to increase as the fabric of the building deteriorates.

Increasing standards, such as improved energy efficiency, may be impossible to implement or very expensive and therefore impose issues that mean the property is no longer a viable investment, due in part to Government involvement. It is not that many years ago that many Local Authorities were undertaking wide scale “slum” clearance programmes because the property was defined as “Unfit” for human habitation, which included such matters as steep staircases that were considered uneconomic to change. As time moves on standards change which may mean an Authority can take enforcement action against a Landlord; so are all such issues factored in when a Landlord purchases a residential investment?

Assessing the risk

Many Academics ask the question of their students “Is Valuation an Art or a Science?” Investment valuation techniques are usually the closest that Valuers come to the scientific aspect of valuation. Professor Brian Cox in his programme “The Wonders of the Universe” stated that science can answer anything provided you know the correct questions to ask. So are Valuers asking the right questions when it comes to valuation of residential investment properties? Here are some points to consider:

Location

Is the property in an area where there has been a consistent demand by suitable tenants?

Are there any foreseeable risks to finding tenants e.g. has the local University got a policy of building its own student accommodation which could reduce demand or are there competing sources for tenanted property, such as a nearby hospital, which would be a positive.

Are the surrounding uses compatible with owner occupation?

If the surrounding property is suitable for owner occupation then this provides alternatives and reduces the risk of just one form of occupation. Some adjacent uses may be more acceptable to tenants than owner occupiers.

Are there the added advantages of good communications and is this an area where that is significant?

Is access to tube stations or motorways of particular significance?

Type and design of property

Is the layout of the property suitable for the tenancies?

Students may like the idea of not only a communal kitchen but also a lounge, but professional tenants may seek the comfort of their own room and want more facilities in the actual room, such as an ensuite shower room.

Is there scope to extend the accommodation?

Room in the roof or basement accommodation. Or has the property been developed already to its fullest extent?

What is the condition of the property?

Landlords (and lenders in possession) may need to employ their own contractors so maintenance will be more expensive and more frequent for older properties. Landlords may not have the advantage that owner occupiers have of undertaking their own DIY work.Damp works are particularly important as this is a key area that attracts enforcement procedure from the Authorities if the tenant complains.

Is the original structure of traditional build?

Some system built property does not attract a mortgage, but is often considered to be a good investment property as the size of accommodation suits the tenants.

Modernisation

Tenants are getting more discerning and may seek more modern interiors, which imposes more frequent capital costs on the investor. The owner occupier can be more flexible.

Utility Costs

The investor has little control over how the tenants will use the heating or amount of water and so more energy efficient property could be considered an advantage.

Use of the property

The more occupants the more intensely used the property then the more routine maintenance that is required.

Type of lease/agreement

What form of agreement is in place – how easily can the investor get access?

In some cases tenants want more security of tenure and this may be advantageous to the investor who is in there for the longer term, but will this suit the lender?

Market factors

The ease with which the property can be sold influences the illiquidity to the investor

This may vary from location to location, for different types of property.

All these factors assist the Valuer in determining where this form of investment fits within the spectrum of other investments. Therefore what risk is the investor, and the lender if associated with a mortgage, taking when compared with placing money, say in a Building Society with government protection up to a certain limit? The Building Society will certainly be offering a much lower return to reflect the security of the money and the hassle free investment. The rate of return may vary depending on what restrictions the investor wants to impose on redeeming the investment, so a 3 year term with limited access will usually command a higher reward than instant access to the money. There will be tax on the interest earned. Even so there is no such thing as instant access to a property as it needs to be sold usually involving agents and solicitors with their associated costs. Taxes can be imposed in the form of Stamp Duty and usually Capital Gains Tax if the investment has improved in value.

The buyer of a property may insist on certain works being undertaken and depending on the state of the housing market this may be a cost to the seller, so a reduction on the capital growth. Regrettably there is limited, if any, published research into the benefits of capital growth in residential property and what this equates to in real terms. It is also a lottery as to what the rate of inflation will be in a particular area, partly as the sale time is not predictable. However, by following certain criteria those properties at less risk of growth can be established, but the Valuer needs to ensure that his/her client is fully aware of the risks and shares that decision making responsibility.

Consideration of all those factors help a Valuer determine the risk at a point in time to an investor. Clearly where the option of owner occupation is readily available then this reduces the risk and means the Valuer has the option to use that methodology, but that should be made transparent to those involved in the transaction. Even though the owner occupation route may be the recommended route by the Guidance either from your Professional body or client, the Valuer should always have regard to how the property would fare as an investment. Comparison of yields on other investment properties is a good benchmark to assess the risks associated with such an investment, but the experienced Valuer has collected this information over a period of time and the new starter needs to undertake some comprehensive analysis of the market to develop that expertise.

The answers to the questions may not always be easy to find and in such cases this must impair the confidence in the assessment of risk and ultimately value. Those scientists who determined that the world was flat were clearly asking the wrong questions so Valuers need to ensure they are getting the right answers to avoid their valuations falling flat!